OPINION | Why we must wait for Trump | Superannuation is key

OPINION

Sadly, recovery from the Covid19-induced economic crash will almost totally depend on the actions of the narcissistic, erratic, sociopath in the White House.

Let me explain.

With apologies to Leo Tolstoy, every market boom is similar; every market crash is different. In Australia, this one is different from the global financial crisis, the crash of 1987, the oil shock of the 1970s, and the crash of 1929 in several ways. Those differences will most likely determine its duration and who are the big losers and who gains.

Obviously, unlike other crashes, this one was caused by a pandemic, not the usual case of asset bubbles and fear outweighing greed.

Secondly, Australia now has vast superannuation reserves.

Thirdly, internet and mobile phone use is now almost universal. Other than the trades, construction, logistics and personal services, almost all of the rest of the economy can work online.

And lastly, the underlying financial system is fairly sound, and certainly not as shaky as 2008, 1987, the 1970s and the 1930s.

The chief investment officer of one major industry superannuation fund (among others) put it this way. For recovery to take place we need three things:

- Central banks reassuring the market that there’s ample liquidity so that credit can keep flowing to solvent companies.

- Governments cushioning the collapse in demand by announcing massive fiscal programs.

- And passing the point of peak infections in the US.

The first two conditions have been or are being met. The third depends on Donald Trump and whether people in his administration can neutralise his narcissism, erraticism and sociopathy. These are perhaps the three worse traits a leader in a crisis can have.

Trump’s narcissism will mean that much-needed scientific advice will be ignored because Trump thinks and has said that usually he knows more about any subject than anyone else and that he is in the best person to make decisions – often on gut feel.

He irrationally described the impact of Covid19 as similar to that of car accidents, as if car-accident victims can spread road trauma. He keeps downplaying it.

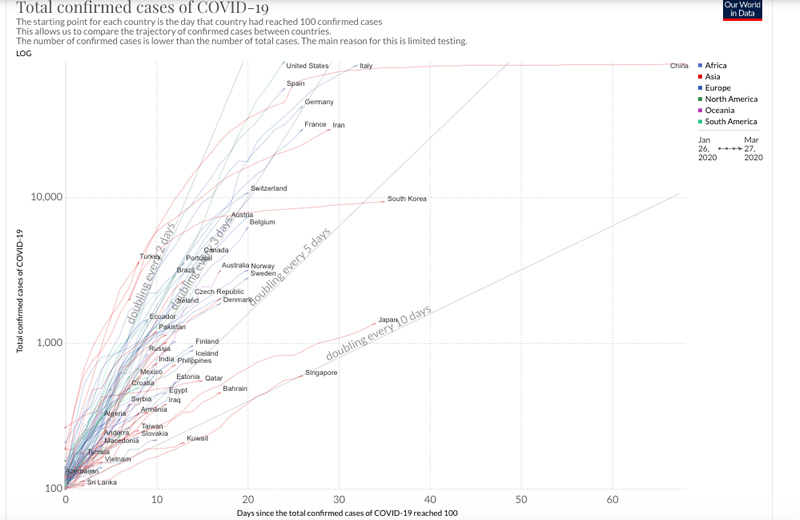

Click here to see live version

Further, it means he will act in his own interests first, irrespective of national interest or the overall best interests of the people. His re-election will dominate his thinking. Until Covid19 hit, the booming stock market, economic growth and low unemployment were about his only electoral assets. They are now gone.

At present, he says he would like to ease restrictions by Easter Sunday so the economy can move again and people could “go to church” – ever an eye out for the evangelical vote.

Then we have his erraticism. So often he makes decisions (leave Syria, close the Mexican border, fire Rex Tillerson) and Tweets them almost immediately, so he can be seen to be in control. Then he often goes back on those decisions – all the time never understanding the risks or consequences.

This is precisely what is not needed in a crisis.

His sociopathy makes him the wrong leader to deal with a pandemic. Without empathy for people he is incapable of making decisions balancing the inconvenience and economic cost of restrictions with justified fears of disease and death.

The three character traits, unless restrained, could easily become a deadly cocktail. Moreover, Trump could end trashing the very economy he is trying to preserve. But if that does not happen before election day he will not care.

Sadly, we are in his hands. With a more sensible and selfless President, the crisis – both health and economic – would be at the stage where we could see the light at the end of the tunnel.

The internet and mobile phones have enabled a lot of businesses and government functions to carry on.

But the big buffer is superannuation. In December 2019 Australia’s superannuation assets stood at around $3,000 billion. The government will allow people access to $20,000 from their fund. That will provide some much-needed short-term liquidity, but it has a long-term downside on the generational divide – yet another one.

The older people get the more they change their superannuation accounts away from growth and higher risk to lower-earning but safer strategies, either capital guaranteed or “sustainable”. Often these people have less need to access their funds. Younger people, however, will grab the $20,000 or whatever lesser amount they have in their account.

The funds will pay them. Most funds, especially larger industry funds, have large amounts of cash investments which they can sell to meet the withdrawal demand, rather than selling shares at a low price, locking in the loss.

In effect, when people rush to withdraw their $20,000, the superannuation funds will be buying what in effect is their shares at rock-bottom prices. When the market returns the funds overall will make a large gain. Unfortunately, that gain will go mostly to people who did not have to draw on their super in this time of financial stress. The rich get richer.

Even with that downside, however, Australia’s compulsory superannuation scheme will go a long way to help recovery.

Another way this crash is different is that people are not rushing to safe investments – gold and bonds – as in previous crashes. Rather, many people who need cash to tide themselves and their businesses over are selling the safe investments because they cannot bear to lock in the loss by selling shares at such a low point.

It is as if they are assuming that once the pandemic is controlled the share market will boom back straight away, unlike after previous big crashes when the market took a long time to recover. We will see if they are right.

That will depend on whether Congress, the Administration and State Governors can limit the worst of Trump’s decision-making. Or whether they let this man so wrapped up in himself do away with the restrictions on movement and gathering that are needed to halt the spread of the virus, in the misguided and unscientific belief the share market and economy will be booming at election time.

———-

Crispin Hull is a current columnist and former Editor of the Canberra Times.

Have an opinion or point of view on one of our stories or a community issue? Please submit a Letter to the Editor here.

* Readers are encouraged to use their full details to ensure letter legitimacy. Letters are the opinions of readers and do not represent the views of Newsport or its staff. Letters containing unlawful, obscene, defamatory or abusive material will not be published.

Got a great news tip or video? We'd love to see it. Send news tips to editor@newsport.com.au

Comments are the opinions of readers and do not represent the views of Newsport or its staff.

Reader comments on this site are moderated before publication to promote valuable, civil, and healthy community debate. Our moderation takes into consideration these guidelines and rules before comments are approved for publication.