OPINION: Minimum-wage earners victims of a tax scandal

CRISPIN HULL

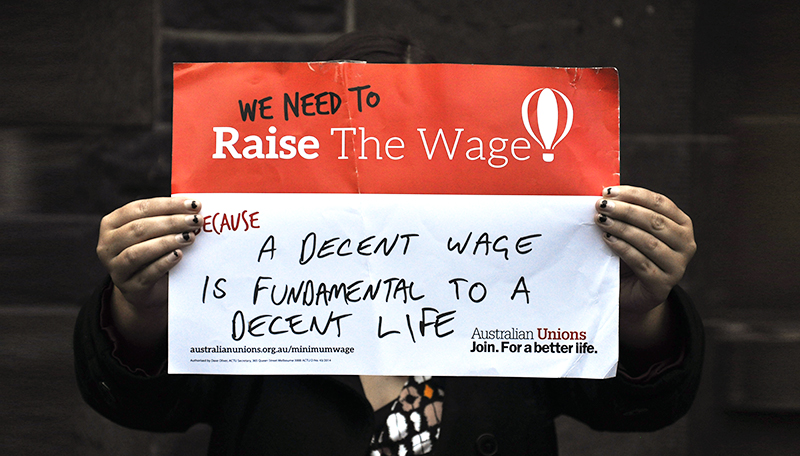

THE minimum-wage earners are knocking at the door and just one more increase like the one this month will push them through it. The door is the second tax rung above which they will pay 34.5 per cent of any additional income in income tax and Medicare levy.

It is a scandal of unfairness. These people have very few deductions, so once the minimum wage surpasses $37,000 which it will almost inevitably do after the next rise, they will be paying more than a third of their marginal income (any extra income in the form of overtime or penalty rates) in tax. The same marginal rate as all the people earning up to $87,000. How can that be fair?

There is a big difference between $37,000 (penury) and $87,000 (getting by fairly easily).

That rate and threshold will not have been changed for eight years come June 2018 when it will still apply. And there is no promise to change it after that.

This pushing of minimum wage earners into the next tax bracket may seem like a trivial matter, but it explains some of the disengagement and disenchantment with politics in recent times.

Britain has a similar problem – a single 20 per cent tax bracket stretching from very low earners (about $19,000) to people who are reasonably okay ($75,000). In the US, they start taxing from the first dollar earned.

People do not complain much about tax, but they do complain about take-home pay and what it can buy. At the heart of that is the tax system. And when people have to pay more from their own purse as the public provision of things like health and education retreats, they get upset.

In Australia, it was not even a negligent over-looking of the plight of those on minimum wages. It was a deliberate over-looking. The Turnbull Government actually looked at and addressed the effect of inflation on the people whose marginal income fell in that 34.5 per cent bracket.

It thought that it was terrible that inflation had put people on $80,000 a year at the top end of that bracket and in to the next (39 per cent bracket). Something must be done to help them, the Government mused.

So the Government moved the threshold for 39 per cent up to $87,000. But at the bottom end of that bracket, the Government did nothing. It did not cross the Government’s mind that the marginal tax rate on people on just $37,000, now just a slither over the minimum wage, would hit 34.5 per cent.

Even President George W Bush was fond of saying that no-one should pay more than a third of their income in tax. But he was complaining about people on very high incomes having to pay more than a third of their income in tax. In Australia, we face people on the minimum wage having to pay more than a third of their extra earnings in tax.

The political elite, certainly in the Coalition, did not even see people on the minimum wage, let alone empathise with them.

This sort of political disconnect contributed to the Turnbull-May folly of calling early elections to increase their majorities only to leave them politically crippled.

Turnnbull sort of gets it, after the 2016 election scare. He has done a little bit on health, education, climate and donations, but too little, too late.

Tax is a part, a significant part, of the story.

All three countries started reducing top marginal income tax rates and reducing the number brackets in the 1980s. There may well have been some argument for reducing the top marginal rate down from highs of between 60 to 70 cents in Britain and Australia and for moving towards consumption taxes to help reduce avoidance. But they should have had more income steps at the lower end, but the political elites were blind to that end of the tax scale.

Indeed, we could do away with tax brackets altogether and have a gradually increasing rate with a tiny increase in the rate for each dollar earned – a straight line rather than a series of steps.

The reduction in the number of brackets and lowering of the higher marginal rates reduced the progressivity of the tax system and contributed to greater inequality. Combined with other things, a rebellion – albeit a peaceful one at the ballot box – was inevitable.

Industrial relations “reform” further weakened the bargain power of labour.

The result has been an ever greater share of national wealth going to capital and a lesser share going to labour and weaker redistribution through the tax system. That has resulted in greater inequality in both income and wealth.

A 2013 report by the ANU Crawford School of Public Policy, 2015 Australian Council of Social Service report and a 2016 analysis of Australian Bureau of Statistics figures by social demographer Mark McCrindle show the trends: the wealth and income accruing to those aged 50 to 65; and an ever greater share of the total wealth and income going to those at the top.

The middle class is contracting.

The top 20 per cent get half the nation’s income and the bottom 20 per cent get just four per cent.

The top 20 per cent have 63 per cent of the nation’s wealth, 70 times more than the bottom 20 per cent.

It is getting worse.

No-one wants or expects perfect equality, but the greater acquisition of income and wealth by the top 20 per cent is causing a two-class society that did not exist in the 1970s.

One class has high income, including a lot from capital investments, home ownership and simply does not have to worry about having to be to affording things. When they do not like what the public sector has on offer in health and education, they can move to private providers. Moreover, through their lobbying power can skew the public sector into subsidising them.

The other class is younger, with little hope of home-ownership and charged more for public health and education than in the 1970s. This class has to scrimp and are terrified at the prospect of utility bills. They face the double insecurity of often being renters and casual workers.

Both side of politics were and still are being funded by well-heeled lobbyists who time and time again persuade politicians with donations to adopt policy against the public interest – mining taxes; action on climate change; food labeling; property taxes; high immigration; corporatised or privatised utility companies; and so on.

So the message is clear: get your snots out of the trough; stop listening and acting on lobbyists’ agendas and start listening and acting on the fairly reasonable desires of ordinary voters.

Incidentally, my guess is that, judging of Jeremy Corbyn’s performance, Bernie Sanders and Anthony Albanese would have won in 2015 and 2016 – not for their parties but for the people they wanted to represent.

www.crispinhull.com.au

Crispin Hull is a former Editor of The Canberra Times and journalism lecturer at the University of Canberra.

Thoughts? Let us know in the comments below.

* Readers are encouraged to use their full details below to ensure comment legitimacy. Comments are the opinions of readers and do not represent the views of Newsport or its staff. Comments containing unlawful, obscene, defamatory or abusive material will not be published.