Home ownership in steady decline

Thursday August 7 2013

Steady decline in home ownership

The biennial release of the Household Income and Distribution Survey by the Australian Bureau of Statistics (ABS) was made available last week, and researcher Cameron Kusher provides some insight into the survey findings covering the 2011/12 financial year.

According to Mr Kusher, these results provide invaluable insights into the housing market where in particular, it reports on household ownership characteristics across the country, as well as providing an updated review of home ownership and supersedes the information available in the 2011 Census data.

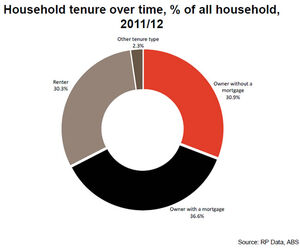

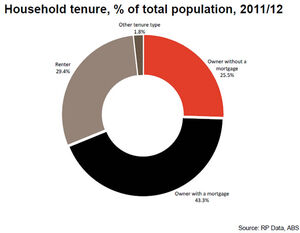

Mr Kusher said, “Of particular interest to us was the household tenure data which is split across four different types of tenure and covers owner without a mortgage, owner with a mortgage, renter and other.”

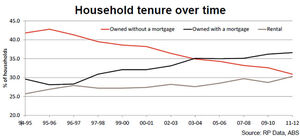

“Over recent years and evident in today’s accompanying graph, there has been a steady but consistent decline in households that occupy a home without a mortgage. Subsequently, there has been a lift in the proportion of households with a mortgage and those occupied by renters,” he said.

The survey results show that over the period 2011/12, 36.6 per cent of households held a mortgage compared to outright ownership at 30.9 per cent and 30.3 per cent for rentals. Mr Kusher said that an interesting finding was that fifteen years ago, 41.3 per cent of homes were owned outright compared to 28.3 per cent which were mortgaged while 27.9 per cent were rented. He said that a rise in the proportion of households that are owned with a mortgage is likely to be one of the factors acting as a handbrake on consumer spending.

“With a recent shift in consumer attitudes away from spending and more toward savings, the high proportion of the population with a mortgage is also likely to be having a dampening effect on retail trade and subsequently economic growth.

“It’s no wonder we keep hearing of retailers doing it so tough. In fact, retail trade figures released this week for the 2012/13 financial year showed that retail trade increased at is slowest pace over a financial year in 51 years. If we consider that a majority of Australia’s rental accommodation is largely privately owned as opposed to a company or the Government, private owners of rental properties either have a mortgage or would own these properties outright – this additional investment in housing by the private sector is probably hindering spending in other areas of the

economy,” Mr Kusher said.

With an election now called, Mr Kusher said that housing affordability should be an election issue however, it looks unlikely. “With low interest rates and the likelihood of further cuts, we are seeing housing transaction activity rise and subsequently, values are also now rising once more. The RBA Governor, Glenn Stevens has previously argued that he would like to see a pick-up in dwelling construction on the back of low interest rates rather than an increase in home values,” he said.

Figures to June 2013 show that dwelling construction has been moderate to-date; there were 157,650 new homes approved for construction over the 2012/13 financial year. Mr Kusher said that although this appears to be quite a lot, it is -1.5 per cent below the 20 year average. “It must be noted that approvals over the year were 5.2 per cent higher than over the 2011/12 financial year. As we know, over the 12 months to July 2013, capital city home values have increased by 4.9 per cent.

“With lower economic growth forecasted coupled with higher rates of unemployment, we would anticipate that the high proportion of residents with a mortgage will continue to spend in a restrained manner, particularly if they hold a large debt and are concerned about job security,” Mr Kusher said.